table of contents

| List | details |

|---|---|

| developer | Fanny Soft |

| operating system | Android |

| file | hsfical |

| update | v5 |

| category | UtilitiesApplication |

| main function | It is possible to calculate the future value, present value, inheritance tax, and gift tax of assets. Deposits and savings calculators and features to calculate repayments including interest on loans. Easy financial calculator to finance your finances. The future/present value function calculates the value of money based on a specific point in time. Ability to calculate loan status, repayment amount, term and interest rate. Pension calculation functions such as national pension and four major insurances. Year-end settlement calculator provided |

Editor’s review

It is a financial app that everyone from beginners to those looking for retirement should have. It calculates the interest and tax to be received by depositing a large amount of money for a certain period of time using simple and compound interest. In addition, the savings calculator reflects the asset value by entering the amount, interest, and repayment method when depositing a certain amount each month. Also, you can compare the gift tax and inheritance tax, which are taxes you have to pay if you give out property for free, to see how you can pass it on to your children. Also, if you are a citizen, you can calculate the pension you have to pay. Check out the National Pension, Retirement Pension, Personal Pension, and 4 major insurances.

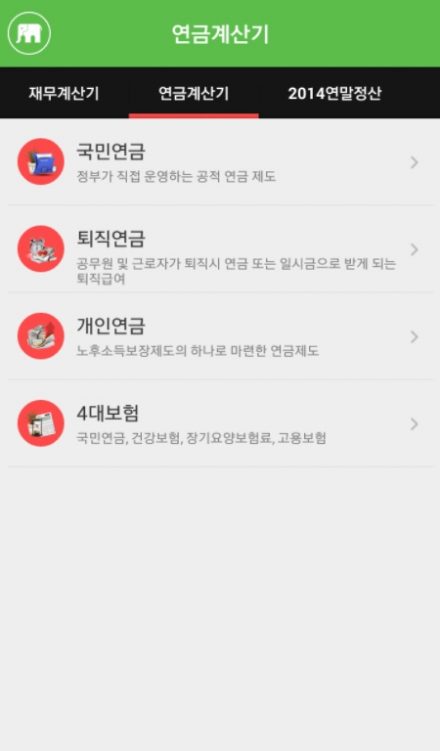

screenshot

Key features and usage

There are many ways to do financial planning without consulting an expert. Among them, there is a way to check through the app. It aims to create your own asset management framework. 앱에서 제공하는 탭은 3가지로 분류할 수 있습니다.

financial calculator items

In the Financial Calculator tab, you can manage consumption and expenses by comparing the future and present values of assets.

Enter the amount to be saved each month through the savings calculator and savings calculator. You can calculate the interest rate for simple or compound interest using the interest rate provided by your financial institution. Also, you can enter the loan amount, period, interest rate, and repayment method in the loan repayment item.

Pension Calculator Items

In the Pension Calculator tab, you can calculate items such as National Pension, Retirement Pension, Personal Pension, and Four Major Insurances. The third tab provides items for easy year-end settlement.

In the pension calculator, you can enter your current age and set the desired pension amount when you retire, the starting age of the annuity, and the period of receiving it. Also, check how much pension you will receive when you retire. If you enter your current assets and annual salary, you can calculate your annuity.

Year-end settlement calculator items

For year-end tax settlement, you can view deduction data at Hometax through simplified data or provide a simple calculator. Check the guide through the year in which the year-end tax settlement begins, and look at your deduction rate and deduction limit.

FAQ

The Android financial calculator app allows you to calculate the future value, present value, inheritance tax, and gift tax of assets. It also provides a savings and savings calculator and a function to calculate the repayment including interest on the loan. Easy financial calculator to finance your finances. The future/present value function calculates the monetary value based on a specific point in time, calculates the loan status, calculates the repayment amount, and calculates the period and interest rate.

The monthly income based on the National Pension is the amount excluding tax-free earned income. After entering information in the National Pension Calculator, you can check the upper and lower limits. Monthly income is calculated by dividing 365 by the total income for one year of the salary item for which payment is agreed upon at the time of joining the company and multiplying by 30.

If you don't, there are no legal issues. Also, if the annual salary is less than the number of deductible family members (1 person 14.08 million won, 2 people 16.23 million won, 3 people 24.99 million won, 4 people 30.83 million won), the income tax amount is 0, so there is no need to do it. However, it is generally recommended to do year-end tax settlement. Because all of my income could be left unspent. This may result in waiving taxes that may be refunded.

reference material

Related software

Other related programs include: